Breaking News

Market Trends

Revolutionizing Dynamics: The Surge of New Equipment in Machinery Markets

Benjamin Hughes

March 5, 2024 - 22:25 pm

Surge in New Equipment Supply Alters Dynamics of the Used Machinery Markets

LINCOLN, Neb., March 5, 2024 – In recent reports, Sandhills Global has been closely examining the current state of the machinery markets. Last month's observations pointed to a significant uptick in factory-new equipment. Trucks and trailers began to flood the market, while dealers noticed an accumulation of late-model assets on their lots. Continuing this trend, Sandhills Global's latest market reports, now featuring a dedicated analysis of the U.S. used planter market, indicate this pattern is persisting. These comprehensive reports span various sectors, including the U.S. used construction equipment, farm machinery, truck, and semi-trailer markets featured within Sandhills' marketplaces.

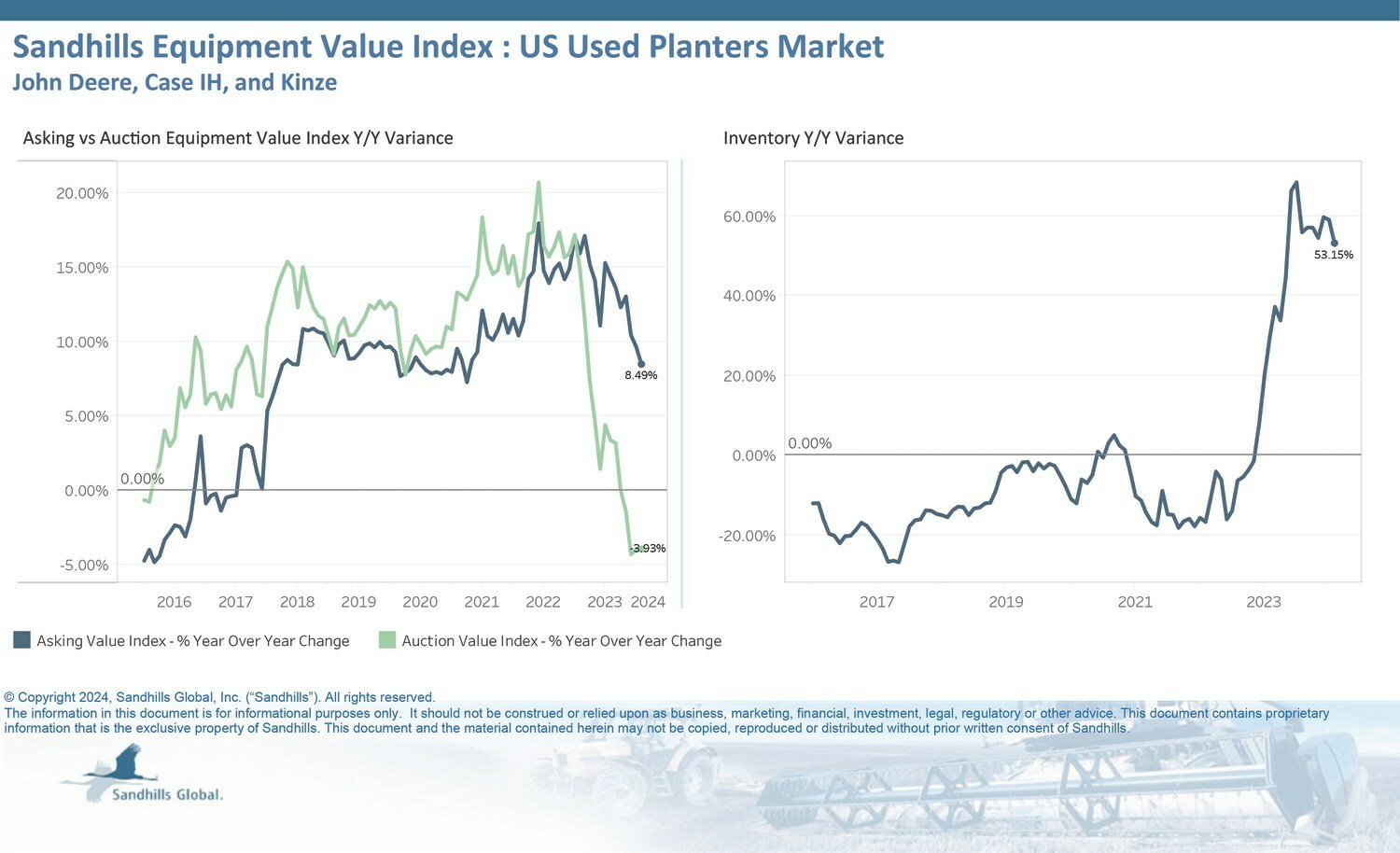

Market Trends in U.S. Used Planter Sector

The company has introduced a new market report for the U.S. used planter market that scrutinizes industry trends, particularly within leading brands such as John Deere, Case IH, and Kinze. There's been an observable shift in the inventory levels of used planters; despite a 4.39% month-over-month decline in February, attributed in part to seasonal reductions, the year-over-year inventory levels have spiked by an astounding 53.15%, with current trends exhibiting a lateral movement. Sandhills now offers this market report Sandhills Global.

Pivotal Findings in Used Farm Equipment

Sandhills' analysis reveals a period of transition for the used farm machinery landscape. Following the pandemic era, disruptions in production and supplies have dissipated, giving rise to consistent new manufacturing activities. This change impacts inventory levels as they stood much higher in February, showing an upsurge of 39.48% year-over-year, coupled with a significant month-over-month augment of 5.13%. Details of this trend can be seen on photographs like the one here InMktRp_0224_Chart2_Farm.

U.S. Market for Used Compact and Utility Tractors: An Overview

The U.S. market for used compact and utility tractors has seen the availability of late-model units soar. Inventory levels have climbed 22.9% on a year-over-year basis, despite a 1.66% decrease over the previous month. The graph depicting this trend is available for viewing and downloading InMktRp_0224_Chart3_Tractors.

Heavy-Duty Truck Market Experiences Variable Dynamics

In the realm of used heavy-duty trucks, inventory levels have risen by 12.18% year-over-year as of February. Despite the notable yearly increase, the month has seen inventory levels remain relatively flat with a modest 0.85% decline, suggesting a downward trend. This trend is highlighted in a visual format here InMktRp_0224_Chart4_HDTrucks.

Used Semitrailer Market: Analyzing the Shifts

The U.S. used semitrailer market, particularly in the dry van category, has experienced pronounced inventory and value fluctuations over the past two years. Inventory levels decreased by 2.49% month-over-month in February, which might suggest a move towards market stabilization; however, they are still up by 42.32% year-over-year, with current trends moving laterally. The chart with more details can be viewed here InMktRp_0224_Chart5_Semitrailers.

Growth and Decline in the Medium-Duty Truck Segment

February saw a 4.34% month-over-month increase in inventory levels for the used medium-duty truck market, along with a notable 27.48% year-over-year rise. This trend signifies a growing market. Despite this, values have been consistently dropping after months of decline, with asking values down 3.05% month-over-month and 15.03% on a year-over-year basis. To explore the data visually, interested parties can click here InMktRp_0224_Chart6_MDTrucks.

Trends in Heavy-Duty and Medium-Duty Construction Equipment

In the used heavy-duty construction equipment sector, an uptick of 6.2% month-over-month and 14.56% year-over-year in February suggests an upward trend. While individual machines show depreciation year-over-year, the overall value index is escalating due to the influx of late-model inventory – a nuance specifically evident in excavators with lower operating weights. The visual data can be found here InMktRp_0224_Chart7_HDConstruction.

Similarly, the medium-duty construction equipment market is undergoing considerable growth and adjustment. Sandhills Global has noticed that despite the depreciation of individual machines year-over-year, the total value indexes have risen due to the availability of newer late-model inventories. February's report showed a year-over-year inventory rise of 59.76%, with a 4.76% month-over-month increase after several successive months of growth. The chart is accessible via this link InMktRp_0224_Chart8_MDConstruction.

Stability and Pressure in the Used Lifts Market

The sector for used lifts is showing stability signs with only a 0.9% month-over-month decrease in inventory levels; nevertheless, it was up 10.07% year-over-year. The telehandler category, in particular, is propelling inventory increases, consequently exerting pressure on market values. This segment of the market, steadfast for now, may soon encounter stress from heightened inventory levels, most noticeably within specialized categories such as telehandlers. To view more on this topic, please visit InMktRp_0224_Chart9_Lifts.

Insights From Sandhills Global's Market Reports

Ryan Dolezal, Sales Manager at TractorHouse, emphasized that the increasing availability of late-model equipment, a trend initially observed with high-horsepower tractors and combines, is now becoming more apparent across various equipment categories over the past year, affecting the used planter market as well. As the planter market evolves with higher-speed technologies, larger row units, and retrofitting, it's increasingly important to monitor the implications on used retail and auction pricing. This observation complements the reports prepared by Sandhills Global, offering valuable insights into the machinery markets. Interested readers can explore more at TractorHouse.

Sandhills Equipment Value Index (EVI): An Essential Market Tool

An integral part of Sandhills' market reports is the Equipment Value Index (EVI), which assists buyers and sellers in tracking market movements and optimizing return on investment and business strategies. EVI covers auction and retail data, as well as the active model year equipment. Notably, Sandhills recently implemented enhancements to the January 2024 EVI including weighted adjustments. These changes recalibrated historical EVI metrics back to 2005, and all reports for the year 2024 will now reflect these improvements. Consequently, previous figures are not directly comparable to this new, more refined data set.

Accessing Full Market Insights

For those interested in a more granular analysis, detailed reports from Sandhills Global are available upon request. These reports underscore pivotal changes within the markets for used heavy-duty trucks, semitrailers, farm machinery, and construction equipment. Sandhills Global invites queries via email at [email protected], providing additional market insights derived from their extensive research capabilities.

Sandhills Global: Connecting Industries with Information

Sandhills Global, headquartered in Lincoln, Nebraska, is an information processing company that specializes in amassing, processing, and distributing data across a multitude of sectors. These industries include but are not limited to construction, agriculture, forestry, oil and gas, heavy equipment, commercial trucking, and aviation. Sandhills Global's industry-specific approach integrates technologies and services to facilitate efficient, secure, and successful business operations, from large enterprises to small firms. More information about how Sandhills Global can streamline the operation and growth of businesses can be found at www.sandhills.com/contact-us.

Closing Note: Sandhills Equipment Value Index

To reiterate, the Sandhills Equipment Value Index (EVI) is a key barometer for used asset valuations across varied industries. Maintained by Sandhills Global marketplaces such as AuctionTime.com, TractorHouse.com, MachineryTrader.com, and TruckPaper.com, and powered by FleetEvaluator, the EVI lends essential insights into shifting supply-and-demand conditions across each sector. For further details or assistance, contact Sandhills Global directly at the provided link and telephone number.

SOURCES: Sandhills Global

port connect pro© 2024 All Rights Reserved